LOCATION:

Rural Saskatchewan highway

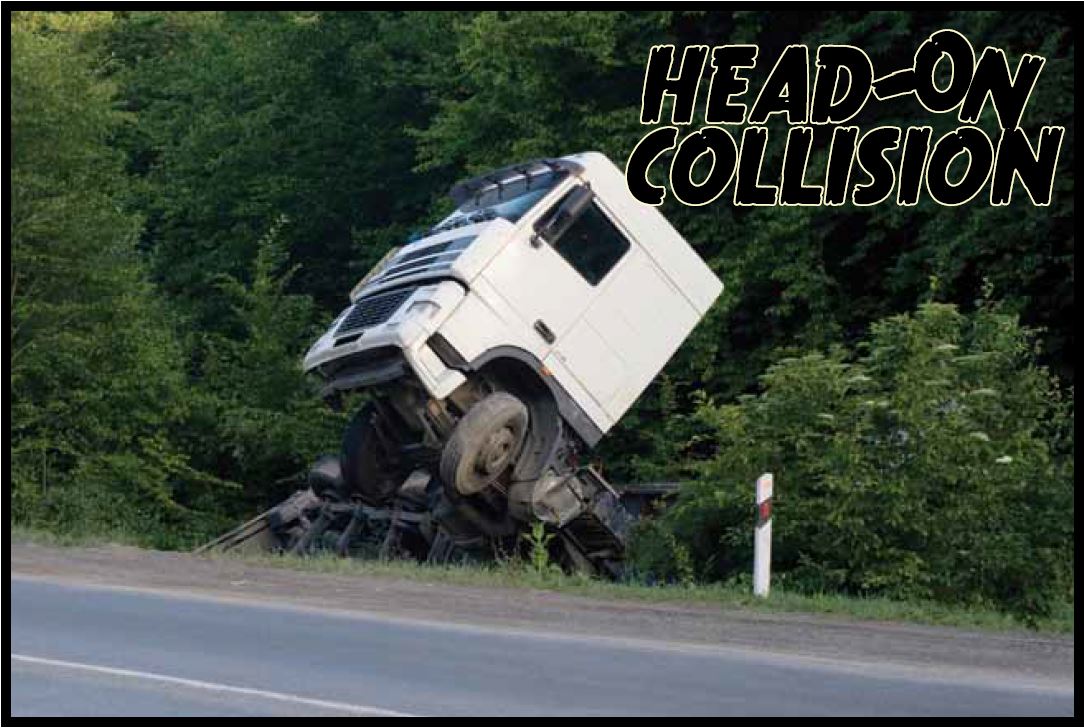

CAUSE OF LOSS:

Head-on collision

COST OF LOSS:

Total loss: $2.5 million. (Truck and horse trailer: $250,000; Property damage – horses, truck and

trailer: $2.5 million)

DETAILS OF LOSS:

A young son was driving his mother’s car on a rural Saskatchewan highway. He crossed the centre

line and collided with a semi-tractor trailer, causing the semi, trailer and cargo (competition horses)

to be deemed a total loss. The insured had basic plate coverage of $200,000 and $1 million liability

on the policy. Due to the special design of the trailer and its use, a large loss of use claim occurred.

As well, the horses were expensive animals and brought a large property damage claim of

$2.5 million. The insured was not covered for approximately $1.3 million of the claim.

LESSONS LEARNED:

Always carry the right amount of insurance for your protection – though basic plate insurance is

significant, it may be necessary to purchase more coverage to be fully protected from all losses. In

this case, for an additional $60, the total loss would have been covered.

Do you have lots of STUFF? Whether you are a tenant, condo owner or homeowner having a record of your belongings will always come in handy in the case of a claim. And they're also kind of fun to fill out!

Keeping an up to date record will help you stay organized in the case of a claim. Suffering any sort of loss to your dwelling can be an overwhelming experience, and having a list of the details of your belongings and their values makes going through the claims process much simpler and less stressful than having to recall everything off the top of your head. This list can also help you make sure your insurance coverages are enough to protect you in the case of a total loss.

You might even find this list handy for many other uses (maybe it will even spur a garage sale)!

You can print off a list of common household items and personal belongings here. We can even hang on to a copy in your file for you to make sure it is safe.

Do you have STUFF?

If you are hosting a fundraiser or any other event on the golf course this summer, a Hole-In-One competition on a certain hole can be exciting and a great selling point to your event. But what if you don't have the million dollar prize to pony up yourself when one of your attendees pulls out their lucky driver?

Hole-In-One insurance is one of the many specialty coverages we sell that can allow your next golf event to have that extra oomph. If you're thinking this might be a great addition to your day on the links, we need to following information to get you a quote:

- Date of tournament or event

- Location

- Hole to be insured

- Yardage

- Number of golfers

- Prize value

Call or email us at broker@alhattieinsurance.ca for a free quote on your next golf event.

Did you know, your condominium building has insurance on the structure but no coverage for your belongings or any improvements that have been made to your unit? This is where Condo Insurance comes in. Whether you're living in the unit or renting it, Condo insurance is designed to provide you with that coverage your building lacks. Coverage for your belongings, for your renovations and upgrades, additional living expense, contingent coverage and building deductible assessment that keeps you protected if your building itself isn't adequately insured or the building deductible gets transferred to you. They all provide you with personal liability and can be upgraded to include several options, including:

- Increased Limits for property with specific amounts of protection, like jewelry or musical instruments

- Reduced Glass Breakage Deductible

- Sewer Backup

- Voluntary Firefighting coverage

- Watercraft coverage

- Seasonal Home coverage

- Rental Home coverage

You may be eligible for discounts if:

- claims free for over 3 years

- approved monitoring and security system

- fire resistive structure

- above third floor

- age and loyalty

- you choose a higher deductible

We ask that you take a moment to fill out a record of your belongings. You can print off an inventory worksheet to fill in values and year of purchase to most household items. Once you have a fairly complete list, add up the total replacement value plus an amount for restoration expense. This is what you will be wanting to base your coverage for under your contents. You can then contact us (1-888-450-2700), visit our office, or request a free quote online with this value we can discuss your options and what policy will best suit your needs and budget.

All vehicles registered in Saskatchewan are required to be plated, which provides a high deductible and the most basic coverages and liability. But benefits provided by Auto Paks can make sure your family and your bank account is well protected in case of a serious accident. Here are some quick facts about Auto Paks:

- Make accidents affordable. Pick from a range of deductibles from $700 down to $50!

- Don't even pay the deductible! If you hit wildlife, or suffer damage due to fire, lightning or your vehicle is stolen your deductible is waived.

- Financial protection is provided through liability coverages ranging from $1 million to $5 million in the event of a law suit against you.

- Keep your family safe with coverage protecting from injury and loss equal to your liability amount (up to $2 million).

- Adding the Loss of Use coverage will keep you on the road after an accident, covering you for rental costs.

- It doesn't just cover your vehicle, but also extends to vehicles you have rented or borrowed.

- Buying Replacement or Repair cost coverage within 120 days of purchasing a new vehicle will allow you to preserve the value you paid for, fighting off depreciation.

- You can receive a discount for scheduling multiple vehicles on one policy.

Thinking an Auto Pak might be right for you? Get a free online quote!