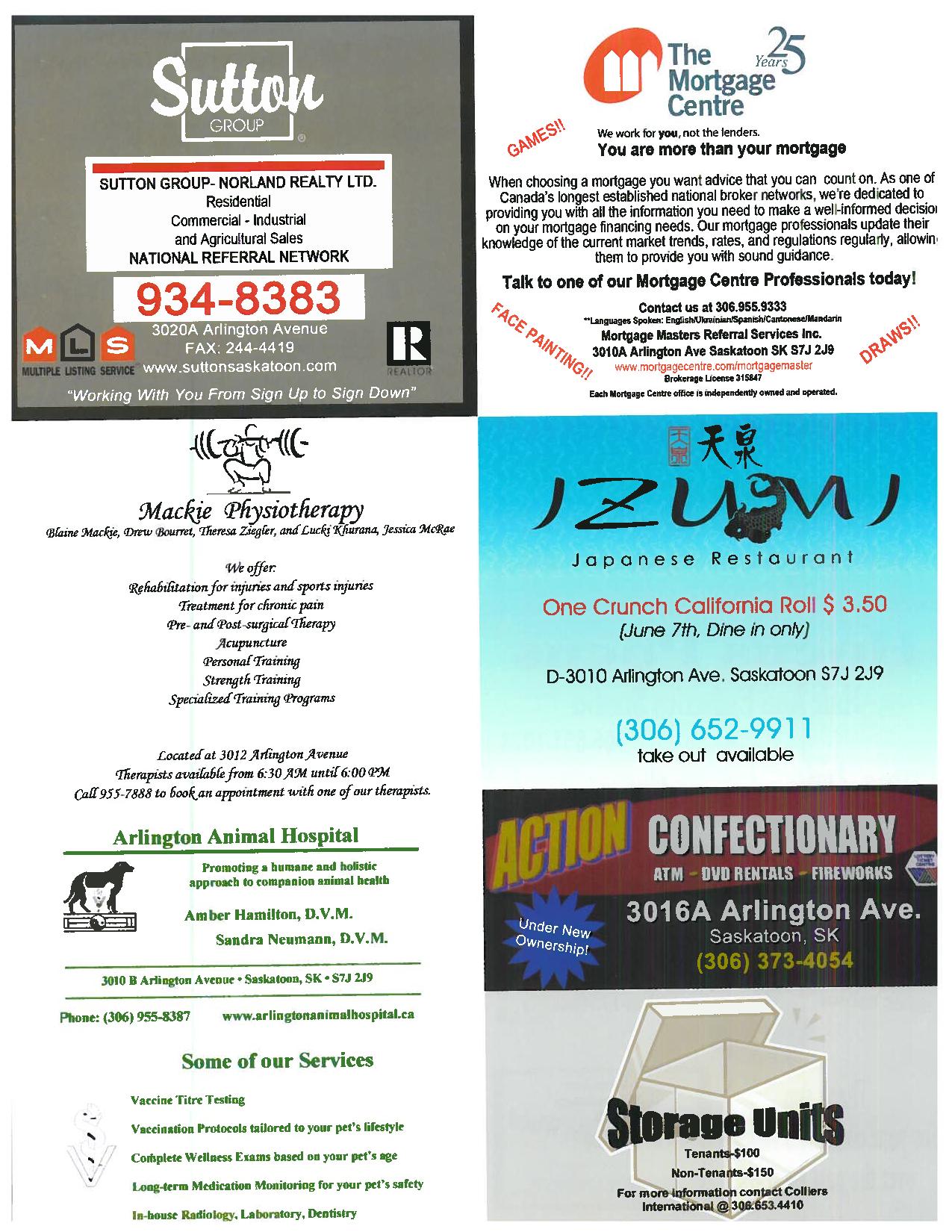

Join us on Saturday June 7th for our mall's Customer Appreciation Day! We will be hosting a Car Seat Clinic, a free Shred-It Station (with Food Bank donation) for your documents, and a free Child Find ID Clinic. The full day's event's can be found on the flyer below. Thank you from our family for having us as your Saskatchewan Insurance Brokerage for over 30 years!

In an effort to reduce the high rate of injuries and fatalities on Saskatchewan's roads, the Special Committee on Traffic Safety will see several key recommendations turn into law effective June 27, 2014. One of the primary changes will effect new drivers caught driving under the influence of drugs or alcohol, who will face a 60-day license suspension and will have their vehicle seized for three days.

"Harsher penalties are aimed at deterring the unsafe choices some Saskatchewan drivers are making," said Donna Harpauer, Minister responsible for SGI. "We want drivers to think twice before making a bad decision, like getting behind the wheel after drinking or texting while driving."

Other traffic laws being introduced in the province June 27th include:

- Impaired drivers face user-pay installation of an ignition interlock device on their vehicle, for a minimum nine months on a first offence and up to five years for subsequent offences.

- Drug-impaired drivers will face the same consequences as drinking drivers.

- Drivers caught using their cellphone while driving for the second time within one year will have their vehicle seized for up to seven days.

- Drivers will face harsher penalties when they're traveling at 35 km/h or more over the speed limit.

- Booster seats will be mandatory for children under seven years of age, less than 145 cm (4'9") in height and under 36 kg (80 lbs) in weight.

- Photo radar will be piloted at three high-risk locations across the province and in school zones.

Motorcyclists will also note changes, with a focus on new riders:

- Riders in the Motorcycle Graduated Driver Licensing (MGDL) program and their passengers will be required to have their arms and legs covered, wear hand-covering gloves, ankle covering boots, and either an approved three-quarter, modular or full-face motorcycle helmet.

- MGDL riders will have to place a placard on their license plate to indicate they are a new rider.

- Drivers will be required to hold a Class 5 or higher driver's license before applying for a motorcycle learner's license.

- New riders will have to demonstrate their ability to operate a motorcycle through a basic ability test or successfully complete an approved training program, before getting a motorcycle learner's license.

For more information about these traffic safety changes, visit SGI's website at www.sgi.sk.ca.

We are very happy to announce that we will be holding a free car seat clinic in our office's parking lot on Saturday June 7th from 9am-3pm. Bring your vehicle, car seat and child and the registered car seat techs will make sure that your car seat is properly installed, sized and answer any additional questions you may have.

There will additionally be a Shred-It station that will dispose of any documentation in exchange for a donation to the Saskatoon Food Bank.

More details to the event will be announced in the coming months as confirmed.

When plating and insuring your vehicle in Saskatchewan, whether it be your winter beater or your brand new SUV, it's important to understand your options and what you are getting in terms of coverage and deductible.

When purchasing an Auto Policy, you are not just plating your car, you are getting a customizable insurance policy that protects you and your family from loss not covered by basic plate insurance. You gain several key additions including:

- Increased liability coverage from $1 million to $5 million

- Lower deductibles from $500 to $50

- Waived deductibles if you hit wildlife or have damage due to fire, lightning or theft

- Rental car coverage (which includes protection against damages to the vehicle)

- Increased injury benefits

Additional options:

- Replacement cost coverage on brand new vehicles (must be insured within 120 days of vehicle delivery)

- If your vehicle is totaled in the first 24 months, your deductible may be waived and your vehicle is replaced

- If your vehicle is repairable, only new parts will be used

- If your vehicle is leased your original purchase price is protected, covering the difference between what you owe your leasing company and the actual cash value of the vehicle

- Loss of use coverage for alternative transportation in the event of a claim

- Road hazard glass coverage including chip repair

There are many examples of how an Auto Policy can provide necessary benefits in coverage. For instance, if you injure a high salaried person in a collision and must pay to supplement their lost income, Auto Policy pays for costs not covered by basic plate insurance. You may face significant financial hardship if you're found at fault for damaging someone's property or if someone gets injured.

Getting the right protection is about the best combination of basic plate insurance and an Auto Policy tailored to your needs.

We strive at Al Hattie Insurance is to ensure that as a policy holder at our office you are properly covered under your insurance to cover modern claims scenarios in Saskatchewan. In years past, $1 million in liability coverage to a home, tenant, condo, or auto policy may have seemed more than enough. Unfortunately, this year has seen several claims rising not only above the $1 million but $2 million mark. Due to this trend, we are making sure that our customers are aware of the rising cost of fire and other claims to make sure they are fully covered in case of an accident.

A major fire claim in May this year was one of several incidents that show that rising cost of living and growing density in the city and province inevitably are leading to higher and higher claims. As people's busy lives don't always leave them enough time to or to study the claims market, we strive to make sure that you as the insured are provided with coverage that will do what it is supposed to in case of an emergency; make sure you are going to be covered in case of incident.

As of Jan. 1st 2014 all home, condo, tenant, and auto policies are going to be automatically renewed with $2 million liability coverage. We have unfortunately seen claims in the province that are well exceeding the previous standard of $1 million liability coverage and we don't want you to be paying for insurance and still end up with an enormous bill at the end of the day when an accident occurs. On most policies, to raise liability coverage from $1 million to $2 million will only see an increase of $1-$2 per month per unit on your current policy. $2 million liability coverage won't be mandatory, but will now be recommended for all policies as a minimum limit. If you feel like you are at risk of needing higher coverage, it is possible to also purchase up to $10 million liability coverage when you add an 'Umbrella' liability policy.

If you have questions regarding your policy, getting your coverage changed or increased, or don't know what coverage is best for your needs, please call us (306-955-2700 or toll free 1-888-450-2700) or stop by our office at 3020C Arlington Ave and talk to one of us.