LOCATION:

Rural Saskatchewan highway

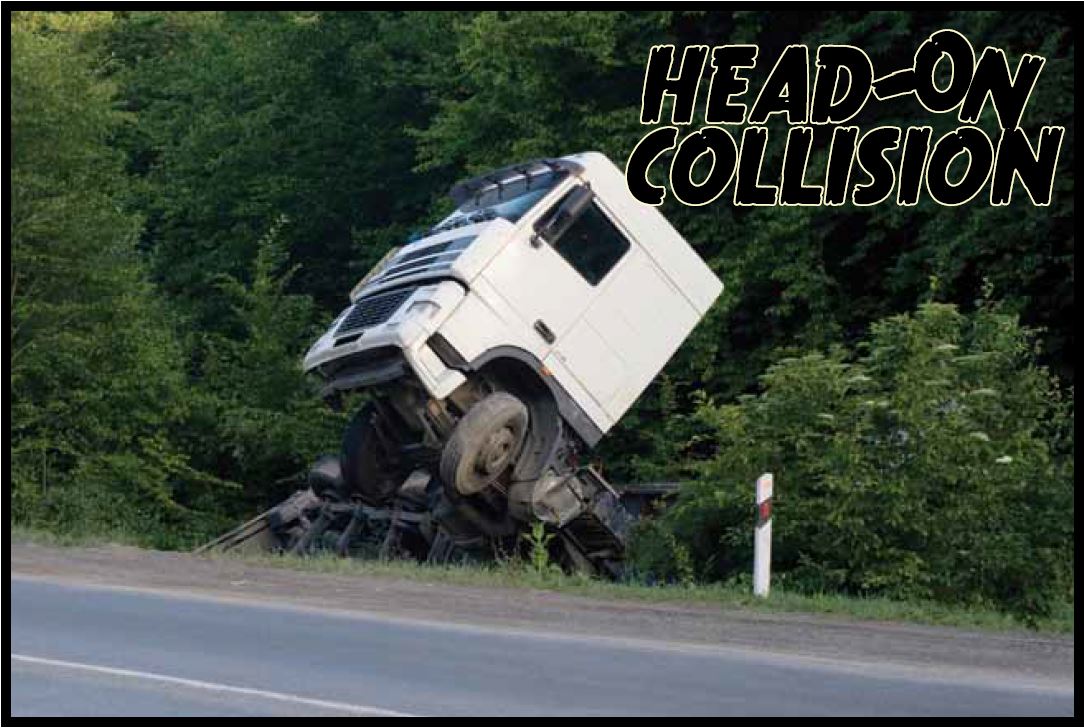

CAUSE OF LOSS:

Head-on collision

COST OF LOSS:

Total loss: $2.5 million. (Truck and horse trailer: $250,000; Property damage – horses, truck and

trailer: $2.5 million)

DETAILS OF LOSS:

A young son was driving his mother’s car on a rural Saskatchewan highway. He crossed the centre

line and collided with a semi-tractor trailer, causing the semi, trailer and cargo (competition horses)

to be deemed a total loss. The insured had basic plate coverage of $200,000 and $1 million liability

on the policy. Due to the special design of the trailer and its use, a large loss of use claim occurred.

As well, the horses were expensive animals and brought a large property damage claim of

$2.5 million. The insured was not covered for approximately $1.3 million of the claim.

LESSONS LEARNED:

Always carry the right amount of insurance for your protection – though basic plate insurance is

significant, it may be necessary to purchase more coverage to be fully protected from all losses. In

this case, for an additional $60, the total loss would have been covered.

LOCATION:

Town home

CAUSE OF LOSS:

Fire caused by an electric hair straightener

COST OF LOSS:

$263,000

DETAILS OF LOSS:

The insureds’ daughter was the last to leave the home in the afternoon to go to work. When the

insureds’ arrived home later they noticed smoke coming from the windows. They went to neighbour’s

house and called the Fire Department. The dwelling and contents in the basement sustained heavy

fire damage, while the remainder of the home sustained smoke and water damage. The Fire

Commissioner investigated and determined the cause of the fire to be the hair straightener left on in

a bedroom located in the basement.

LESSONS LEARNED:

When using electric curling irons, hair straighteners or other appliances that generate heat, be sure

to unplug it after each use and place them in a secure position away from any flammable materials.

Never leave your home without checking to make sure any irons, curling irons, etc. are unplugged

and in a safe location.

Do you have lots of STUFF? Whether you are a tenant, condo owner or homeowner having a record of your belongings will always come in handy in the case of a claim. And they're also kind of fun to fill out!

Keeping an up to date record will help you stay organized in the case of a claim. Suffering any sort of loss to your dwelling can be an overwhelming experience, and having a list of the details of your belongings and their values makes going through the claims process much simpler and less stressful than having to recall everything off the top of your head. This list can also help you make sure your insurance coverages are enough to protect you in the case of a total loss.

You might even find this list handy for many other uses (maybe it will even spur a garage sale)!

You can print off a list of common household items and personal belongings here. We can even hang on to a copy in your file for you to make sure it is safe.

Do you have STUFF?

If you are hosting a fundraiser or any other event on the golf course this summer, a Hole-In-One competition on a certain hole can be exciting and a great selling point to your event. But what if you don't have the million dollar prize to pony up yourself when one of your attendees pulls out their lucky driver?

Hole-In-One insurance is one of the many specialty coverages we sell that can allow your next golf event to have that extra oomph. If you're thinking this might be a great addition to your day on the links, we need to following information to get you a quote:

- Date of tournament or event

- Location

- Hole to be insured

- Yardage

- Number of golfers

- Prize value

Call or email us at broker@alhattieinsurance.ca for a free quote on your next golf event.